The Master of Accounting and Finance (MAccFin) program is Canada’s first and only graduate degree of its kind. Offered to a cohort of fewer than 50 students at the University of Toronto Scarborough (UTSC), MAccFin delivers a personalized educational experience over 12 months of academic study plus one co-op employment term that simultaneously offers you a direct path toward three optional professional designations—CPA, CFA, and ACCA—recognized in Canada and globally. Unlock a world of opportunity at the intersections of accounting and finance.

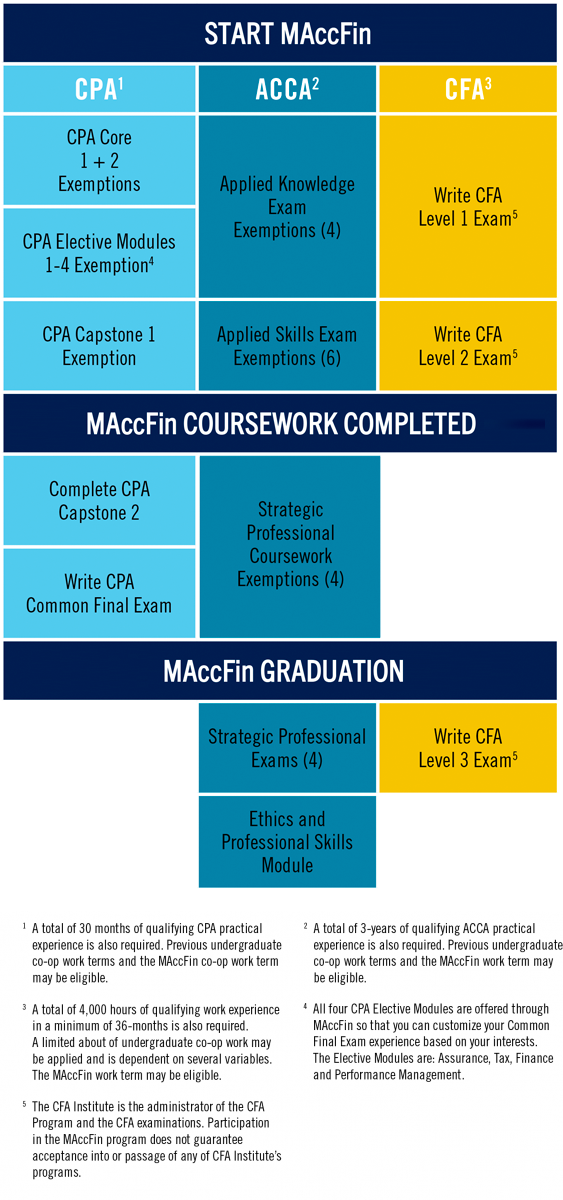

Pathways to CPA, ACCA and CFA Accreditation

- MAccFin will earn you CPA advanced standing and will exempt you from 10 ACCA exams.

- CFA exam preparation is built into our finance curriculum based on the Candidate Body of Knowledge administered by the CFA Institute.

- MAccFin also includes up to four months of qualifying work experience for these credentials.

Your MAccFin Experience

Professional Engagement

- Build strong relationships with your colleagues, professors and advisors.

- Experience our personalized three-month MAccFin Professional Development Program.

- Get mentored by an alumnus.

- Meet professionals and explore the intersections of accounting and finance employment.

- Grow your professional network.

- Train for CFA Level 1 exam.

Academic Study

- Strategy, Governance and Management Accounting

- Economics and Quantitative Methods

- Advanced Corporate Finance

- Investment Analysis and Portfolio Management

- Leadership (6 weeks)

- Data Analytics

- Integration Analysis (6 weeks)

Professional Engagement

- Dig deeper into the intersections of accounting and finance and discover unique opportunities in public practice, corporate finance, capital markets and other financial services.

- Apply to exclusive MAccFin co-op jobs and secure your role for the next term.

- Network with alumni and learn from their success.

- Apply what you’ve learned in a multi-campus case competition.

- Give back and get involved in the MAccFin and UTSC Management community: be an ambassador or a mentor, contribute to a club or program initiative.

Academic Study

- Advanced Topics in Financial Reporting

- Advanced Topics in Assurance

- Advanced Taxation

- Financial Statement Analysis and Equity Valuation

- Derivatives

- Business Development Strategy and Sales (6 weeks)

- Critical Thinking and Decision Making (6 weeks)

Professional Co-op Experience

- Apply and integrate your knowledge and skills on the job.

- Get paid for your hard work.

- Get feedback from your employer and gain the experience to lead.

- Reflect on what you learned from the co-op experience and what it means going forward.

Professional Engagement

- Lock in the first full-time job that will launch your career.

- Support others in the community, make an impact.

- Experience the CPA mentorship program technical training and CPA exam preparation.

- Get trained for, and consider writing, CFA Level 2.

- Celebrate your success!

Academic Study

- Current Issues in Accounting and Assurance

- Investment Analysis and Portfolio Management

- Fixed Income

- Integration Analysis – Board Report

- Advanced Seminar in Accounting and Finance: Learn from the pros

Integrative Learning

- Complete our Integrated Case Writing course (weekend).

- Plan for your career entry.